All Categories

Featured

State Ranch agents sell everything from house owners to auto, life, and other popular insurance policy items. State Ranch provides global, survivorship, and joint universal life insurance coverage plans - indexed universal life insurance for retirement.

State Farm life insurance policy is normally traditional, providing steady options for the typical American household. Nevertheless, if you're looking for the wealth-building opportunities of global life, State Ranch lacks competitive choices. Review our State Ranch Life Insurance review. Nationwide Life Insurance sells all sorts of global life insurance policy: universal, variable global, indexed global, and global survivorship plans.

Still, Nationwide life insurance coverage plans are highly accessible to American family members. It assists interested parties obtain their foot in the door with a reliable life insurance plan without the much a lot more challenging discussions concerning investments, financial indices, and so on.

Nationwide loads the important duty of obtaining reluctant purchasers in the door. Even if the worst happens and you can't get a larger plan, having the defense of an Across the country life insurance policy policy can transform a buyer's end-of-life experience. Review our Nationwide Life Insurance policy evaluation. Insurance companies make use of clinical exams to evaluate your risk class when using for life insurance policy.

Customers have the option to transform rates each month based upon life circumstances. Obviously, MassMutual supplies exciting and possibly fast-growing chances. Nonetheless, these plans have a tendency to carry out finest in the future when early deposits are greater. A MassMutual life insurance policy agent or monetary consultant can aid purchasers make strategies with room for adjustments to meet short-term and lasting financial objectives.

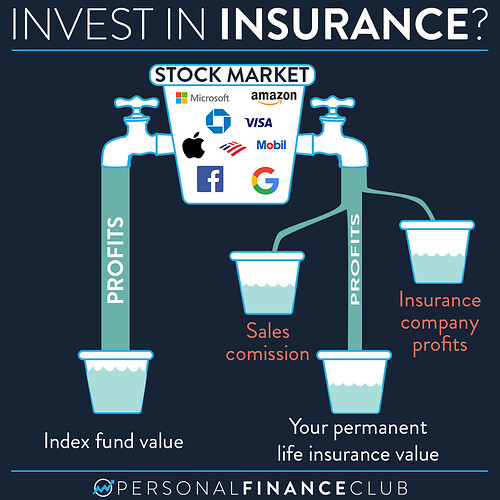

Pros And Cons Of Indexed Universal Life Insurance

Some purchasers may be stunned that it uses its life insurance policies to the general public. Still, military participants appreciate unique advantages. Your USAA policy comes with a Life Event Choice motorcyclist.

If your policy doesn't have a no-lapse warranty, you may even lose protection if your cash money worth dips below a certain threshold. It may not be a fantastic alternative for people that merely desire a death advantage.

There's a handful of metrics through which you can judge an insurer. The J.D. Power client fulfillment ranking is a great option if you want an idea of just how clients like their insurance coverage plan. AM Best's financial strength ranking is another vital metric to think about when choosing an universal life insurance company.

This is particularly vital, as your cash money value expands based on the investment options that an insurance provider uses. You ought to see what investment choices your insurance carrier offers and compare it versus the goals you have for your plan. The most effective way to locate life insurance policy is to collect quotes from as several life insurance policy firms as you can to recognize what you'll pay with each plan.

Latest Posts

Iul Insurance For Retirement

Equity Indexed Life

Indexed Universal Life Insurance Quotes